Top Pet Insurance Companies of 2024 Revealed

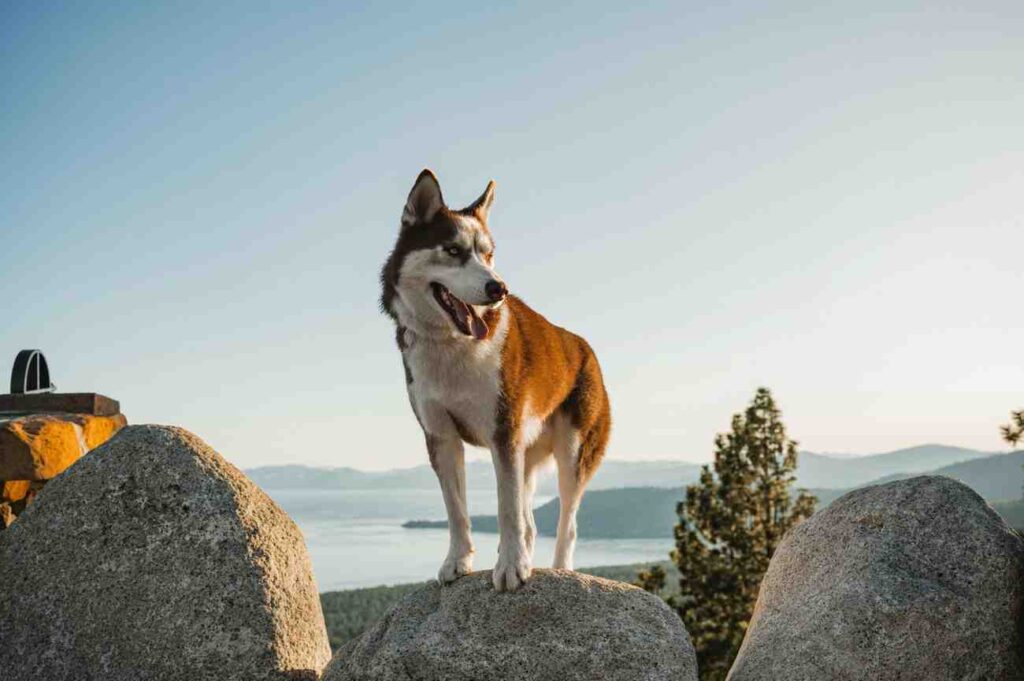

Pet insurance is a smart investment to protect yourself from unexpected veterinary expenses. Whether it’s a sudden illness or an unforeseen accident, having the right coverage can ease the financial burden of taking care of your furry friend.

This guide highlights the top pet insurance providers in 2024, comparing their plans, pricing, and features. We evaluated them on key factors such as coverage options, customer service, cost, and overall reputation. Read on to discover the best pet insurance companies that can help you keep your pet healthy without breaking the bank.

Lemonade: Best Overall Pet Insurance

Lemonade tops our list as the best overall pet insurance company, scoring 96 out of 100 for its comprehensive coverage, competitive pricing, and excellent customer service. Lemonade offers flexible plans that cater to various needs, from basic accident and illness coverage to comprehensive wellness care, making it an ideal choice for pet owners, whether you have a small cat or an active Golden Retriever.

Pros:

- Charitable giveback program.

- Short 48-hour waiting period for accidents.

- No age limits for coverage.

Cons:

- Does not cover behavioral treatments.

- Limited availability of veterinary care services in only 35 states.

Why We Chose Lemonade

Lemonade’s plans are affordably priced, making them accessible to many pet owners. Customers can select from various coverage limits, reimbursement rates, and deductible options. The company also offers an optional Wellness Plan for routine care and an affordable add-on for comprehensive vet fee coverage, which includes acupuncture and therapy.

One of Lemonade’s standout features is its user-friendly mobile app equipped with AI technology, simplifying the process of filing claims and managing policies. This technology enhances the overall user experience, making it easy for pet owners to handle their insurance needs without hassle.

Plans and Pricing

Lemonade offers a primary accident and illness plan, with additional options for preventive care, vet visit fees, and physical therapy. Exclusions include pre-existing conditions, behavioral treatments, elective cosmetic procedures, and dental care. Based on our research, monthly premiums range from $15 to $30 for dogs and $9 to $15 for cats.

Also Read: 6 Great Advice To New Insurance Agents

Spot: Most Customizable Plans

Spot is recognized for providing the most customizable plans, scoring 91 out of 100. It offers a wide range of coverage options, including accident-only and comprehensive accident and illness plans, making it a great choice for pet owners who want flexibility in their insurance coverage.

Pros:

- Standard plans include microchipping.

- Offers a 10% discount for multiple pets.

- Unlimited coverage options available.

Cons:

- Does not cover pets under eight weeks old.

- Long 14-day waiting period for accidents.

Why We Chose Spot

Spot stands out for its extensive customization options. Customers can choose from seven annual coverage limits ranging from $2,500 to unlimited, three reimbursement levels, and five annual deductibles. This flexibility allows pet owners to tailor their plans to meet their specific needs and budget. Additionally, Spot offers one of the lowest-priced accident-only plans, ideal for those looking for basic coverage.

Plans and Pricing

Spot offers two primary plans: accident-only and accident and illness coverage. Both include exam and vet visit fees. Spot also offers two preventive care options, Gold and Platinum, at flat rates for routine care. Exclusions include pre-existing conditions, cosmetic procedures, and breeding costs. Monthly premiums are between $15 and $25 for dogs and $10 to $15 for cats.

Embrace: Best for Deductibles

Embrace is our top pick for the best deductible options, scoring 93.5 out of 100. It provides flexible and affordable coverage options, making it a great choice for pet owners looking to manage their costs effectively.

Pros:

- Online chat for customer service.

- Covers exam fees.

- Easy policy management through a mobile app.

Cons:

- Highest annual coverage limit is $30,000.

- Limited customer service hours.

Why We Chose Embrace

Embrace offers various ways to lower your premium, including five deductible options and a Healthy Pet Deductible benefit. This unique feature reduces your deductible by $50 each year you don’t file a claim, rewarding responsible pet owners.

Embrace’s user-friendly online platform and mobile app make it easy to manage your policy, file claims, and access customer support. However, the highest annual coverage limit is $30,000, which might be limiting for pet owners seeking higher coverage.

Plans and Pricing

Embrace offers a single accident and illness plan with optional add-ons for Wellness Rewards, covering routine care like vet exams and vaccinations. Exclusions include pre-existing conditions and elective procedures. Monthly premiums range from $25 to $55 for dogs and $20 to $30 for cats.

Choosing the Right Pet Insurance: Key Factors to Consider

When choosing pet insurance, it’s essential to consider factors such as coverage options, exclusions, deductibles, and overall cost. Here’s a breakdown of what to look for when selecting the best plan for your pet:

Coverage Options

Most pet insurance plans cover accidents and illnesses, but the level of coverage can vary widely. Look for plans that cover a wide range of conditions, including chronic illnesses, hereditary conditions, and alternative therapies like acupuncture or physical therapy.

Exclusions

All pet insurance plans have exclusions, which are conditions or treatments not covered by the policy. Common exclusions include pre-existing conditions, cosmetic procedures, and breeding costs. It’s crucial to read the fine print and understand what’s not covered before choosing a plan.

Deductibles and Reimbursement Rates

Deductibles are the amount you pay out-of-pocket before the insurance coverage kicks in. Choose a deductible that aligns with your budget. Higher deductibles usually mean lower monthly premiums but more out-of-pocket costs when you make a claim. Reimbursement rates indicate how much the insurer will pay after you’ve met the deductible, typically ranging from 70% to 90%.

Cost and Value

The cost of pet insurance varies depending on factors like your pet’s age, breed, and location. Monthly premiums can range from $10 to $100 or more. It’s essential to balance cost and coverage to find a plan that offers the best value for your needs.

Final Thoughts

Pet insurance can provide peace of mind and financial security when your pet needs medical attention. Lemonade, Spot, and Embrace each offer unique benefits, making them the top choices for different needs and preferences. Whether you’re looking for comprehensive coverage, customization options, or affordable deductibles, one of these providers is sure to meet your requirements.

Before making a decision, compare quotes and read the policy details carefully to ensure you choose the best insurance plan for your furry friend. Investing in pet insurance is a proactive step toward ensuring your pet’s health and well-being without the worry of unexpected expenses.

For more detailed reviews and information on other pet insurance providers, stay tuned and explore our in-depth guides and resources. Don’t forget to like, comment, and subscribe for more updates on pet care and insurance.

2 Comments